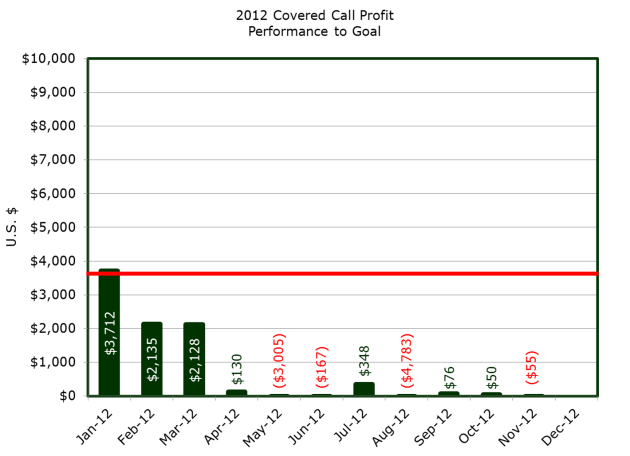

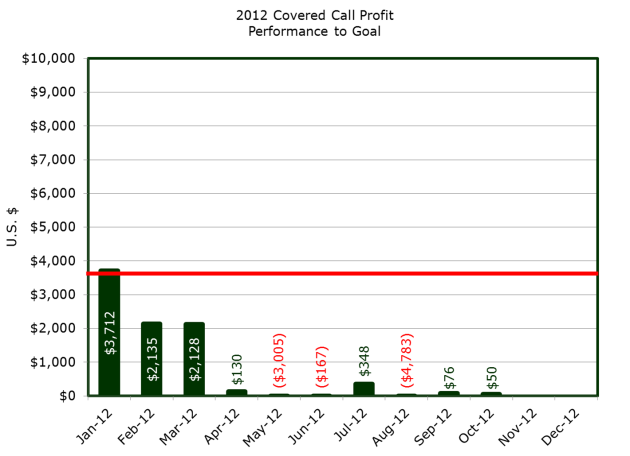

For those of you visiting for the first time, I use basic technical analysis to make trading decisions related to a covered call strategy. Each month after options expire, I review price and market action since the previous option expiration date, as well as any commentary from the previous month’s analysis.

Every investor and trader should review their trades on a regular basis, and this effort helps me improve my ability to “read the tape”.

Enjoy!

November Discussion – General Stock Market

The general U.S equity markets continued to fall over the past 4 weeks. The 3rd quarter was the worst quarter for corporate profits in 3 years, and there is no reason to expect the 4th quarter to be much better. Until there are some signs of strength, protect your capital.

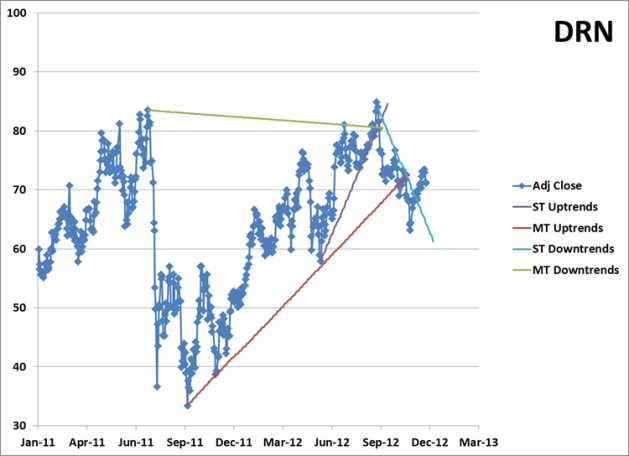

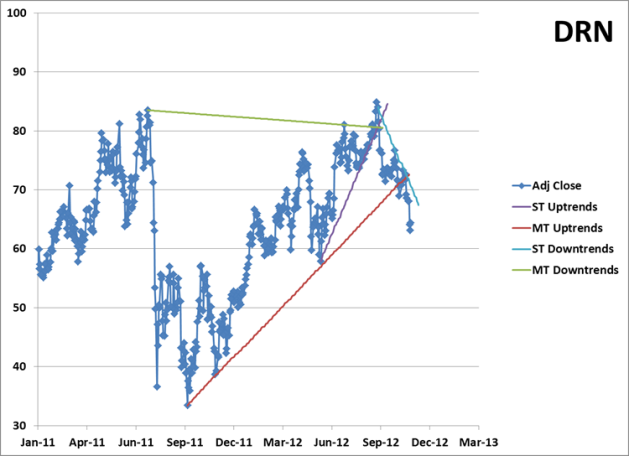

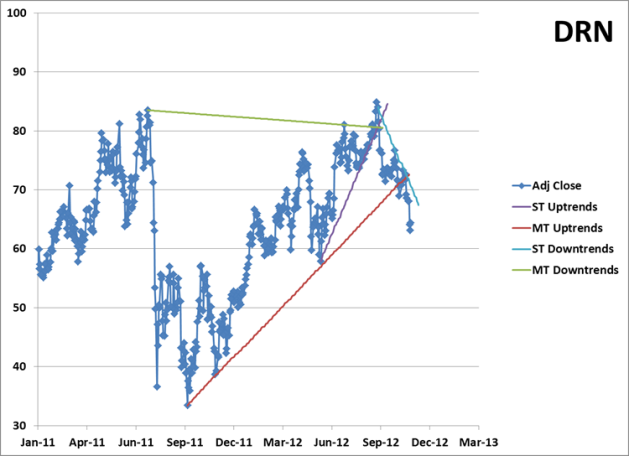

November Technical Analysis for DRN

Here were my thoughts on DRN in October:

DRN was still working its way down to the Sept-Dec-June uptrend when options expired on the 19th. As of the 26th, DRN failed to find support and broke the uptrend, giving us a new, short-term downtrend. All we can do with DRN is watch and wait (red light).

November’s Chart:

DRN is still looking for support. The current downtrend is fairly steep, so I expect to see some constructive price action within the next month or so. Until that time, we’re still in a wait and see mode (red light).

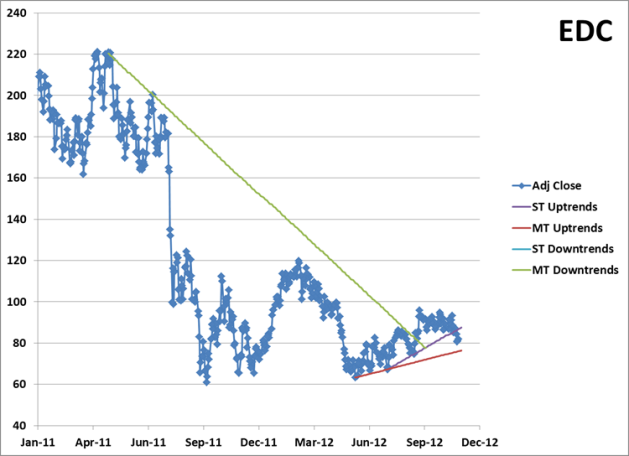

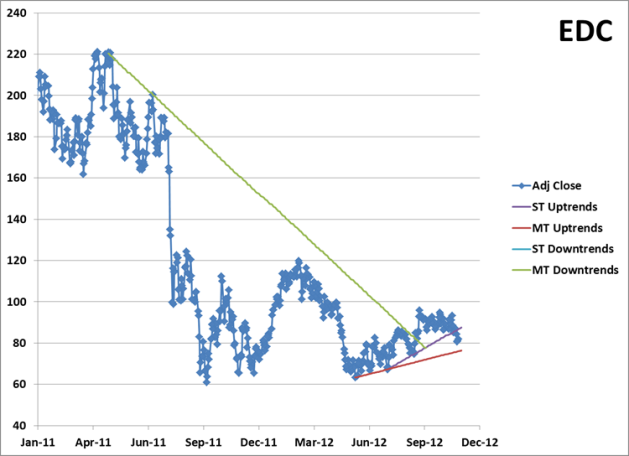

November Technical Analysis for EDC

October’s commentary:

EDC traded sideways in October, staying between the high 80’s and low 90’s. It appears that there is a new short term uptrend (June to September), and EDC’s price is only 5% above that mark. A new uptrend would move the the May-June trendine to a mid to long-term uptrend (still in the mid-70’s), which seems to be a better fit given the uptrend’s small slope. This new development makes EDC a green light for October, which is an improvement from September’s yellow light status.

November’s Chart:

That new, short term uptrend (June to September) was REALLY short. EDC broke it over the last few trading sessions. Now we wait for EDC to test the May-June trendine (high 70’s). Given the U.S. markets recent weakness and all the turmoil overseas (European economy and tensions between Israel and Palestine), EDC gets red light status until it can show some positive price action.

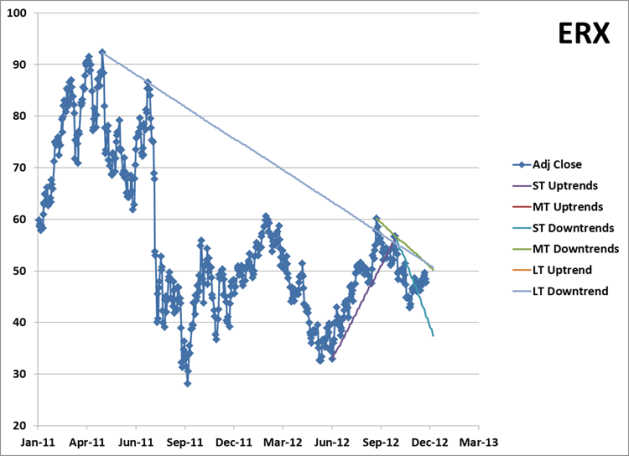

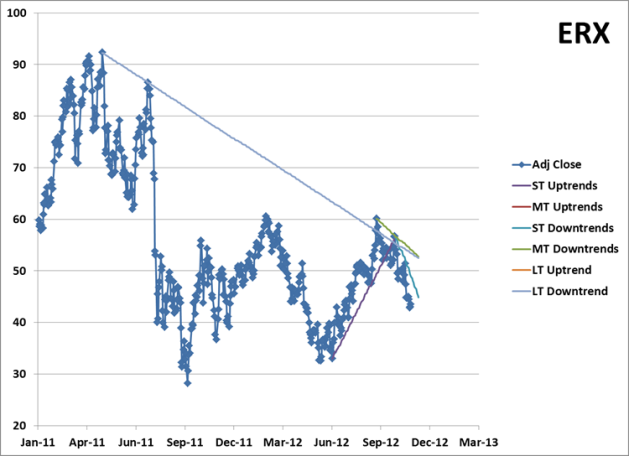

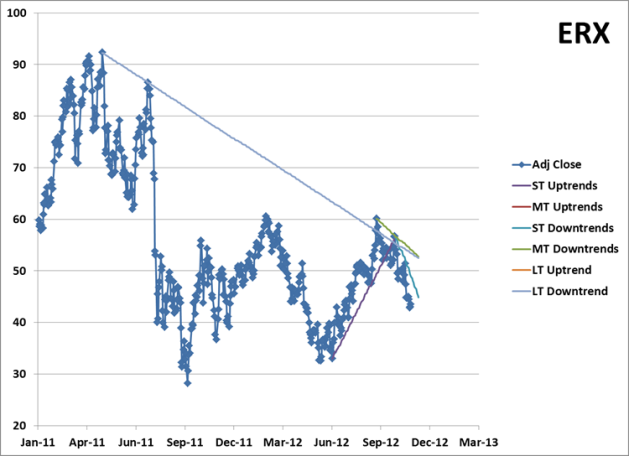

November Technical Analysis for ERX

October’s Commentary

ERX fell back to June-September uptrend and found support for a few days. Unfortunately, that support didn’t last long; ERX broke the uptrend and forced me to sell. There was a brief rally back to that same uptrend, which has now become a new level of resistance. As with DRN, we can only watch ERX for the time being and wait for some new trends to emerge (red light).

November’s Chart:

The ERX price pattern continues to mimic DRN. So the plan is the same; watch ERX for some new trends to emerge (red light).

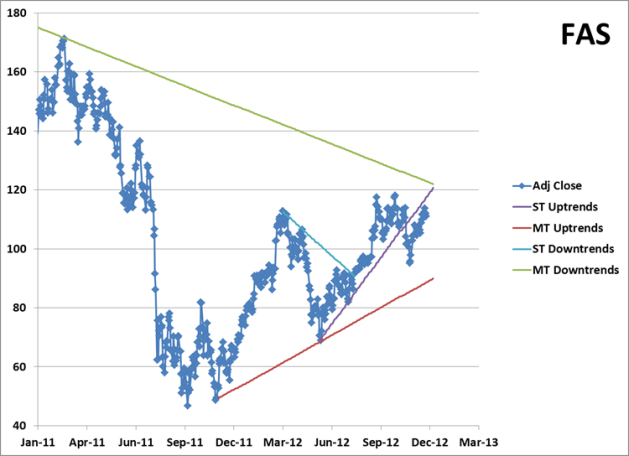

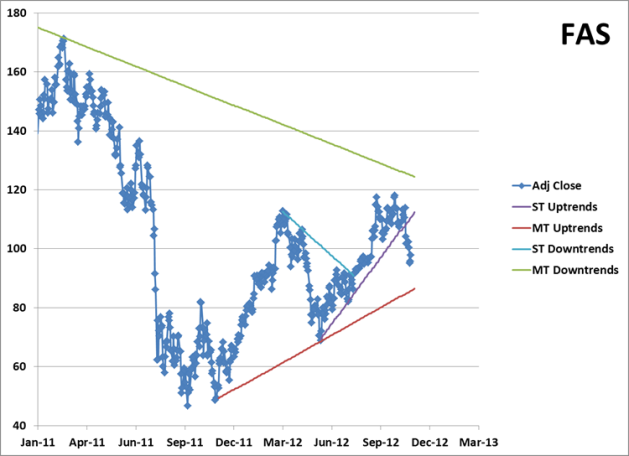

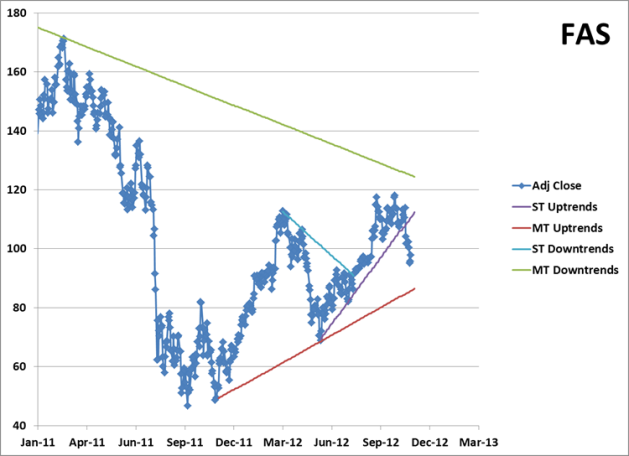

November Technical Analysis for FAS

October’s Commentary

The price of FAS is within a few percent of the short term uptrend, so we’ve entered buy territory. But be careful – the mid-term uptrend is down in the mid-80’s, so a steep sell off could occur if we break the short term trendline. Keep your sell signals at the ready if you do decide to enter a position.

November’s Chart:

Those sell signals came in handy…FAS broke he mid-term uptrend and is now headed towards a support level in the high 80’s. Since FAS is still fairly extended from mid-term support, red light status is the order of the day.

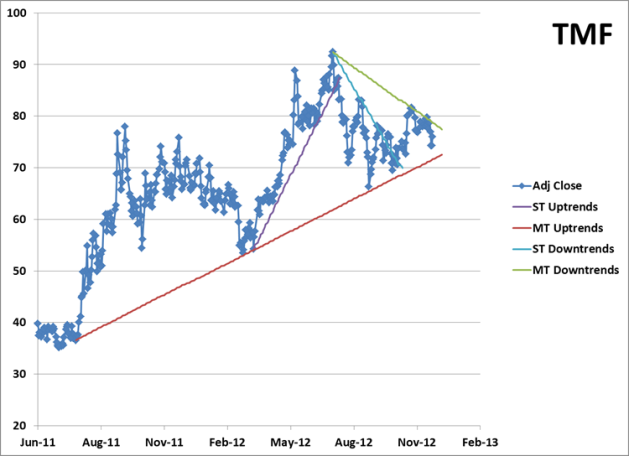

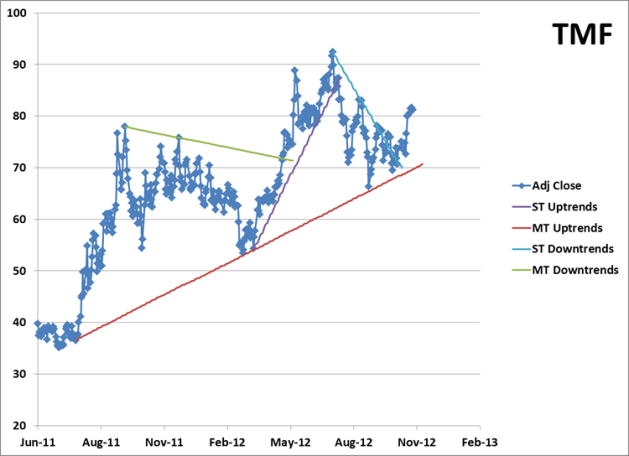

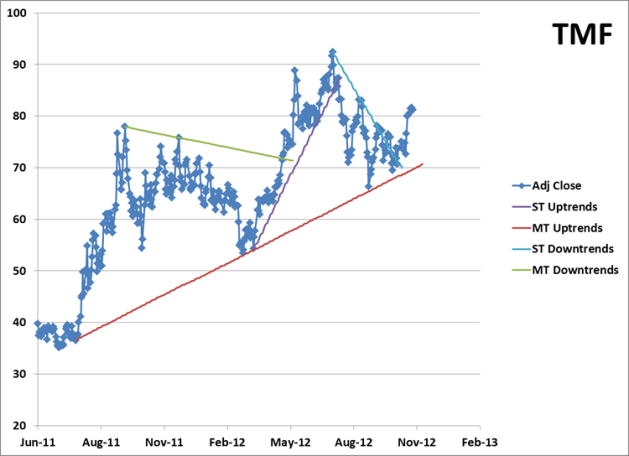

November Technical Analysis for TMF

October’s Commentary

TMF broke the short-term downtrend (July-September) I mentioned last month , but prices were unable to make much headway. Instead, TMF spent most of the month between $70-$75 per share. Since the downtrend is broken, I’m more bullish on this ETF. But I also want to see TMF find support from the Jul’11-Apr’12 uptrend.

November’s Chart:

TMF found support from the Jul’11-Apr’12 uptrend, which is good news. The bad news is that TMF is more than 10% away from the mid-term uptrend. I expect TMF to come down in price, and either test the mid-term trend, or find a new short-term low (yellow light).

Summary

Green Light (Uptrend): None

Yellow Light (No Trend, Range Bound, or Extended from Trendline) : TMF

Red Light (Downtrend or Broken Trendline): DRN, EDC, ERX, FAS